Recently, Beilu Pharmaceutical announced that it plans to use its own funds to acquire 80% of the equity of Chengde Tianyuan Pharmaceutical Co., Ltd. After the completion of this acquisition, Tianyuan Pharmaceutical will become a controlling subsidiary of Beilu Pharmaceutical. The layout of Beilu Pharmaceutical's Chinese patent medicine will be further expanded, forming a dual-drive pattern of "chemical medicine + Chinese medicine," laying the foundation for the company's further development in the pharmaceutical industry.

With M&A, Enrich the Variety of Chinese Medicines and Expand the OTC Market Layout

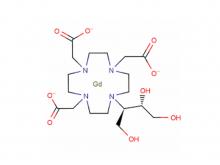

Beilu Pharmaceutical's main business includes contrast agents, central nervous system drugs, hypoglycemic drugs, etc. In recent years, mainstream varieties have been successively included in the national centralized procurement due to policy influences. In this context, by acquiring Chinese medicine companies, the company can quickly layout new tracks and actively create a "second growth curve."

Tianyuan Pharmaceutical is a Chinese patent medicine production enterprise integrating traditional Chinese medicine planting, production, and sales. It has 58 Chinese medicine approvals, including 44 national medical insurance varieties, 18 national essential medicine varieties, and 41 OTC varieties, covering various areas such as clearing heat and detoxification, gastrointestinal, cold, tonifying, blood circulation, and pain relief. Its core product, Jinlian Flower Granules, is the exclusive national variety, national medical insurance category B, OTC category B, with an annual revenue of nearly tens of millions.

Through this acquisition, Beilu Pharmaceutical will be able to quickly enrich the company's product line, expand its OTC market layout, and rapidly build an independent Chinese patent medicine sector.

Clear Strategic Planning to Drive Both "Chemical Medicine + Chinese Medicine"

With the strengthening of residents' health awareness and policy support for the revitalization of traditional Chinese medicine, the demand for Chinese medicine in China is continuously increasing. Especially in recent years, traditional Chinese medicine has made remarkable achievements in public health both domestically and internationally, becoming deeply rooted in people's hearts. It is believed that the top-level system design will continue to strengthen support for traditional Chinese medicine at the national level in the future, and the long-term industry development trend is promising.

Beilu Pharmaceutical has clearly defined strategic planning at the company level and will drive both "chemical medicine + Chinese medicine" in the future. Chinese patent medicine is an area the company has focused on in recent years and is the lever and direction for the company's "second entrepreneurship." On the one hand, the company continues to increase the market share of its exclusive original Chinese patent medicine product Jiawei Zhenxin Granules and has developed various health products around this product, fully creating a series of products as the "first brand against anxiety."

At the same time, the company's wholly-owned subsidiary, Luzhibao Pharmaceutical Co., Ltd., has successfully bid for the right to use 143.335 acres of state-owned land in Bozhou City, Anhui Province, and is actively advancing the construction of the fourth production base, planning to comprehensively improve the production capacity of the company's granules, tablets, capsules, and pill products.

Beilu Pharmaceutical and Tianyuan Pharmaceutical have significant synergies and empowerment in many aspects such as marketing and supply chain management. Through this equity acquisition, the company is expected to comprehensively enhance Tianyuan Pharmaceutical's operational capabilities and performance, rapidly supplement the product line, expand new tracks and channels, stimulate marketing potential, and create the company's "second growth curve."

This equity acquisition is still in the planning stage and further audits, evaluations, and other work need to be carried out. Therefore, the impact on the company's financial condition and business results for the current year will depend on the subsequent formal agreements, implementation, and execution of the parties involved in the agreement. At this stage, it is not possible to predict the impact on the company's operating performance for the current year.

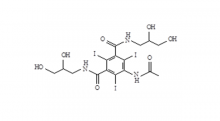

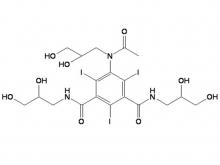

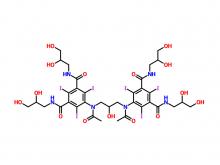

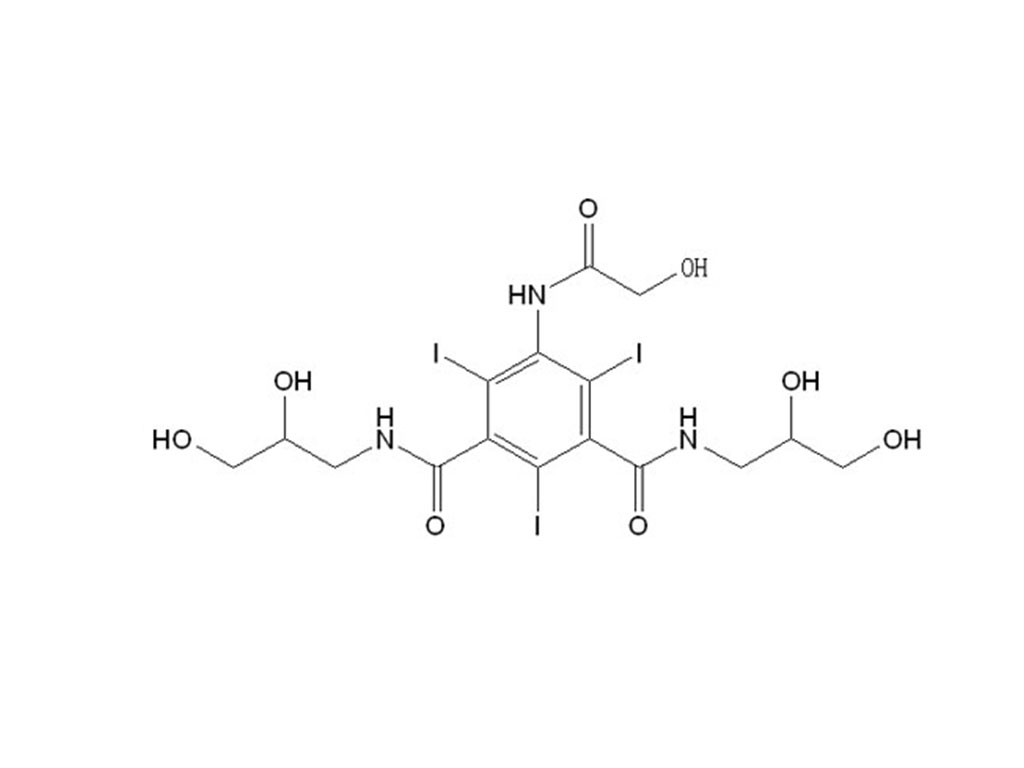

Iohexol Intermediate 5-Amino-N,N'-bis(2,3-dihydroxypropyl)-2,4,6-triiodo-1,3-benzenedicarboxamide

Iohexol Intermediate 5-Amino-N,N'-bis(2,3-dihydroxypropyl)-2,4,6-triiodo-1,3-benzenedicarboxamide

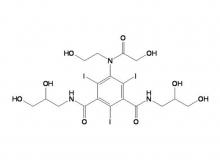

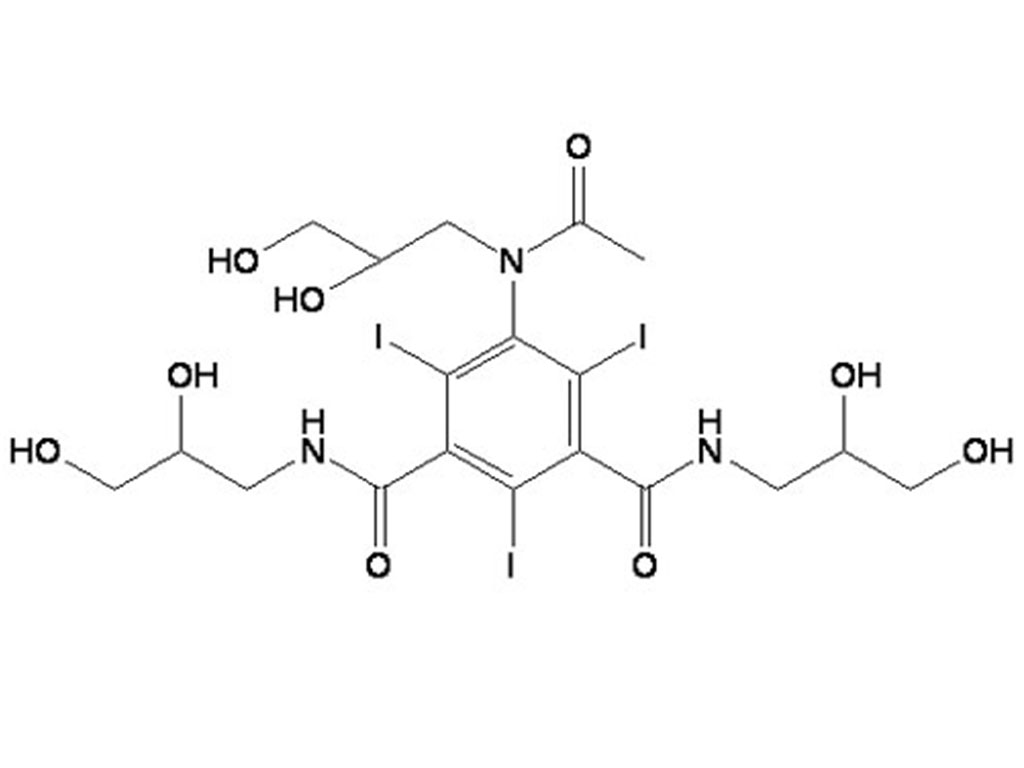

Iohexol/Ioversol Intermediate 5-Amino-N, N'-bis(2,3-dihydroxypropyl)-2,4,6-triiodo-1,3-benzenedicarboxamide

Iohexol/Ioversol Intermediate 5-Amino-N, N'-bis(2,3-dihydroxypropyl)-2,4,6-triiodo-1,3-benzenedicarboxamide

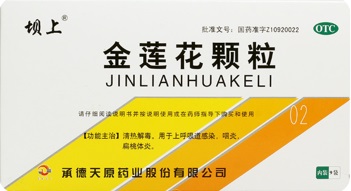

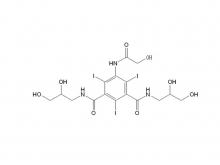

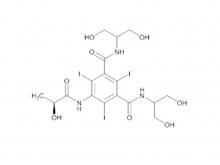

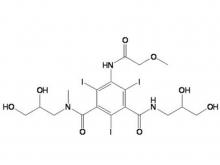

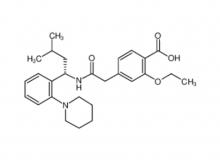

Ioversol Intermediate (order based) N, N'-Bis(2,3-dihydroxypropyl)-5-(glycoloylamino)-2,4,6-triiodoisophthalamide

Ioversol Intermediate (order based) N, N'-Bis(2,3-dihydroxypropyl)-5-(glycoloylamino)-2,4,6-triiodoisophthalamide

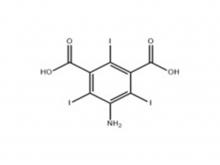

Iopamidol Intermediate (order based) 5-Amino-2,4,6-triiodoisophthalic acid

Iopamidol Intermediate (order based) 5-Amino-2,4,6-triiodoisophthalic acid

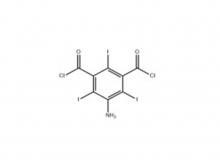

Iopamidol Intermediate (order based) 5-Amino-2,4,6- triiodisophthaloyl acid dichloride

Iopamidol Intermediate (order based) 5-Amino-2,4,6- triiodisophthaloyl acid dichloride

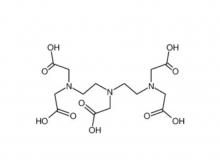

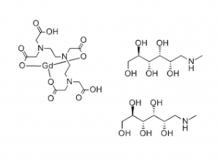

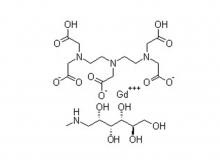

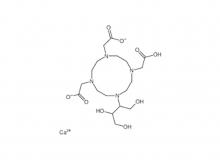

Diethylenetriaminepentaacetic acid (DTPA)

Diethylenetriaminepentaacetic acid (DTPA)

EN

EN

jp

jp  fr

fr  de

de  es

es  ru

ru  ar

ar

![[News] Beilu Pharmaceutical's Wholly-owned Subsidiary, Hong Kong Yuanzhi, Obtains Hong Kong Proprietary Chinese Medicine Registration Certificate for Jiuwei Sleep-Aid Granules](/uploads/image/20260126/hk-subsidiary-obtains-registration-jiuwei-granules_20260126092800_400x400.webp)

Call us on:

Call us on:  Email Us:

Email Us:  No.3 Shuiyuan West Road, Miyun District, Beijing, China

No.3 Shuiyuan West Road, Miyun District, Beijing, China